This article is from the March 10, 2021, issue of Flip the Script, a weekly newsletter moving you from climate stress to clean energy action. Sign up here to get it in your inbox (and share the link with a friend).

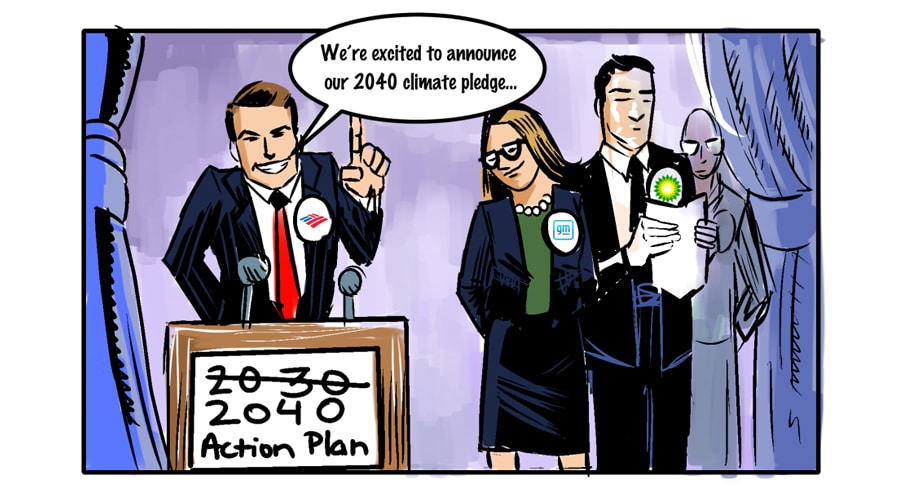

It seems almost daily we’re hearing another awesome corporate pledge to meet new clean energy goals. This is a GOOD thing. Corporate commitments, from automakers, investment firms, and energy companies, are exciting market signals that we’re headed in the right direction. The challenge now will be to move from aspiration to action—and so far, the scorecard for business is mixed.

While many companies are indeed beginning to follow through, it won’t be easy for some major companies, especially those with longstanding ties to the fossil fuel industry, to simply shift their business models overnight, or even to break free from decades of a head-in-the-sand mentality steeped in climate denial and deception. Despite their admirable pledges, these businesses are showing that while talk is cheap, follow-through is a heck of a lot harder. It’s clear that, when it comes to ensuring corporate promises are delivered upon, increased regulatory and public pressure will be key.

Below are a few examples of how, when the rubber actually meets the road, businesses are squirming to shirk their climate commitments—and why we need to keep up the pressure on them to do better.

Exhibit A: Companies at Climate Risk

A big sticking point right now is whether the U.S. government should require companies to disclose the risks they face related to climate change—including potential financial losses related to extreme weather or rising sea levels. Proposed legislation would make it mandatory for thousands of companies (including banks, manufacturers, and energy producers) to use a standardized method to inform investors about social and environmental risks. Supporters say it’s a critical step toward reducing emissions, and that companies owe it to investors to share potential risks, especially if the information could affect a company’s stock price.

The challenge now will be to move from aspiration to action—and so far, the scorecard for business is mixed.

Some businesses are on board and see the benefits of greater transparency on climate. In response to investor demands, several countries, including the U.K., have moved to make climate risk disclosures mandatory. But major companies in the U.S. continue to oppose such regulation, preferring instead to self-police. BlackRock CEO Larry Fink, considered by some to be a corporate climate leader, instead supports a voluntary global reporting standard, arguing that federal oversight is unnecessary and would introduce legal pitfalls for companies. Business groups are calling for flexible disclosure requirements along the lines of those being developed by the G20-led Task Force on Climate-Related Financial Disclosures—but these would be far laxer and harder to verify.

Exhibit B: Is fossil fuel divestment actually happening?

Worldwide, banks, insurance firms, and other big investors are under growing pressure to stop loaning money to fossil fuel companies, buying their stocks, and underwriting their expansion plans. Activists have issued widespread calls for investors to divest from dirty fossil fuels, and so far more than 1,300 institutions have made this commitment, keeping an estimated $14 trillion out of coal, oil, and gas development. In theory, big companies would support fossil fuel divestment, since it provides them a way to honor their climate commitments and to support wider net-zero emission and carbon neutrality goals.

But that’s not necessarily what’s happening. For example, although BlackRock vowed to divest from coal-mining companies a year ago, it still holds $85 billion in coal investments, and at a recent virtual forum CEO Fink disparaged divestment efforts as “greenwashing.” The CEO of Bank of America, the world’s fourth-largest financier of fossil fuels, also dragged his feet on the issue. Climate activist and writer Bill McKibben called this response from the financial community “rigid and so short-sighted,” concluding that “the money men were saying, essentially, go to Hell” and were engaging in their own form of greenwashing through “dodges that, for the time being, allow them to keep lending vast sums of money to the fossil-fuel industry while insisting that they’re very worried.”

Exhibit C: Carbon offsets don’t do nearly enough

Finally, let’s take a look at the steps that companies are actually taking to achieve their net-zero or climate neutrality ambitions. In many cases, the solution is carbon offsets: rather than directly reducing their own emissions, companies seek to lower their environmental impact by supporting “carbon dioxide removal” elsewhere, such as through reforestation efforts. Dozens of large companies, including Apple, Walmart and British Airways, have cited carbon dioxide removal in their pledges for climate neutrality. Shell, for example, aims to achieve its net-zero emission goals by capturing 120 million metric tons of carbon dioxide per year through “nature-based” offsets by 2030. Meanwhile, the company still plans to spend handsomely on oil and gas and to increase its fossil fuel output.

Because of planetary limits, the total volume of offsets that companies rely on will quickly exceed the planet’s ability to provide them…

The problem is, offsets alone won’t do the trick. As Bloomberg columnist Kate Mackenzie explains, companies are making unrealistic assumptions about the “negative emissions” that would come with carbon dioxide removal. Because of planetary limits, the total volume of offsets that companies rely on will quickly exceed the planet’s ability to provide them; yet, recent net-zero commitments “behave as though these constraints don’t exist.” Without genuine action to actually slash emissions in the near term, Mackenzie writes, “net zero risks becoming a fairytale providing cover for the heavy-emitting industries, particularly those in the fossil fuel sector who have aggressively blocked climate action.”

Looking ahead

It’s still not totally apparent how some big companies—particularly the world’s major polluters—will be able to achieve their climate commitments without drastic changes in how they operate. But it’s clear that moving forward, they’ll need to provide more specifics about their intentions. This means providing information on the risks they actually face from climate change, how they’ll shift their investments from fossil fuels, and what they’ll actually do to slash (not just offset) their emissions in the near term. (By near term, we’re talking the next 10-15 years, the urgent timeline we face to really get emissions under control.) Despite admirable commitments, the danger of corporate greenwashing remains very real, and we need to remain vigilant to ensure that ambitious words are followed by genuine, impactful action.

Head here to see a list and track progress of some of the biggest corporate players’ commitments; head here for help with personal fossil-free investing.