Sadly, there’s no shortage of things to be outraged about these days. But here’s a hopeful trend: the movement among the world’s major higher education institutions to cut ties with fossil fuel companies. Just last week, the University of California (UC) system announced that it had fully divested from oil, gas, and other dirty fuels, scrubbing them from its $126 billion investment portfolio. It joins other top names in higher ed, from Georgetown to Cornell to Oxford University, with many more scrambling to join the club.

Divestment is basically the opposite of investment. It involves getting rid of any financial interests—like stocks, bonds, or investment funds—that are unethical or morally ambiguous. Historically, some of the best-known (and most effective) divestments were in things like tobacco advertising or businesses that supported apartheid in South Africa. Today, fossil fuels fall squarely in the same morally questionable, high-risk category.

In total, the UC system sold a whopping one billion dollars (cue Dr. Evil) in fossil fuel assets from its pension, endowment, and working capital pools. It then invested that same amount in clean energy projects, making it the largest school in the U.S. to take the divest-invest plunge.

Divesting from fossil fuels is a huge step forward in protecting our climate because it weakens the fossil fuel industry and accelerates investment in clean energy solutions.

But will divesting put their budgets at risk? Most higher ed institutions rely on their endowments to fund their operations, and, historically, it’s been profitable to invest in fossil fuels. Some schools, like Swarthmore College, have made explicit their worries about putting their asset performance at risk.

The short answer: Not for long. Most fossil fuel companies are a far cry from the attractive investments they used to be: they’re running on a moldy business model, would struggle to survive without the $400 billion in subsidies they receive every year, and have massive balance sheets chock full of assets that could very likely become stranded (i.e., not worth zilch). To put it bluntly, they’ve become risky investments.

Anna Olerinyova, a student at St. John’s College at Oxford, didn’t mince words about her school’s divestment decision: “The fact that the world’s top university is abandoning fossil fuels shows that the age of fossil fuels is rapidly coming to an end.” Now that wind and solar power are competitive with (and, in many markets, cheaper than) fossil fuels, renewable energy is a safer, more profitable long-term bet.

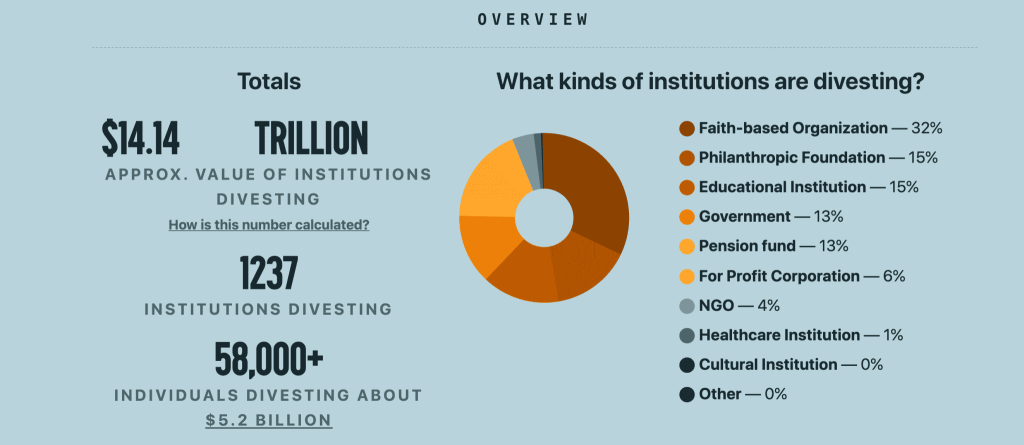

And the movement is snowballing. In the U.S., more than 50 universities have committed to divestment; worldwide, over 1,000 schools, insurance companies, pension funds, churches, hospitals, and other institutions—spanning 48 countries—had committed to fossil fuel divestment by the end of 2019.

Last November, hundreds of protesters swarmed the field of the annual Harvard-Yale football game to demand greater action on divestment. This might seem like small fry compared to the current state of our country. But it’s another sign that the times they are a changin’.

Learn more about how you can divest (starting with your own personal bank) by taking a crash course in divesting and using this handy list of the top 200 fossil fuel companies.

The divestment movement is breaking the hold that the fossil fuel industry has on our economy and our governments. By harnessing the power of the financial sector for good, it can be a huge tailwind in our transition to a clean energy future.

Originally published in the 6/3/20 edition of our Flip the Script newsletter