If your house is among the 80 percent of American homes that are “solar viable” (according to Google’s Project Sunroof), now might actually be a smart time to start powering your home with sunshine. No, we’re not being naïve about the state of the economy or the cash crunch many American households are facing.

The truth is, more and more people are going solar with no money down—and saving money on their electric bill from day one. What is this dark (er…light) magic, you ask? Residential solar technology—and the industry that deploys it—have driven costs down to the point where powering your home with the sun’s energy can, for many homeowners, be cheaper than buying electricity from ye olde utility. As for the no-money-down part, solar owners are increasingly taking advantage of financing methods (like solar loans and solar leases/PPAs) that have become commonplace around the country.

With a solar loan, many homeowners can basically swap out some or all of their monthly electricity bill with a (lower) solar loan payment. A solar company installs a system on your home at little-to-no upfront cost and then you finance the system over time. No forking over cash for panels or installation, and in some cases, you pay nothing for a whole year. And, because you own the solar system, you can still benefit from the federal tax credit for solar (which saves folks an average of $9,000) and other state, municipal, and utility incentives.

Think solar loans sound risky? They’re not. In 2019, the majority of customers paid for their installations using a loan—and they’ve become a popular alternative to outright cash payments for solar.

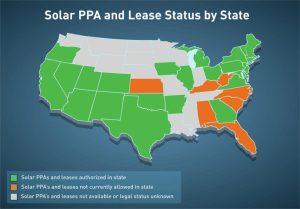

A second affordable financing route is a solar power purchase agreement (PPA) or solar lease. Like a solar loan, PPAs and leases require no upfront cost, and you don’t pay for the panels or the installation. Unlike a solar loan—in which you ultimately own the installation—under a PPA or lease, a third party owns and maintains the system on your home, while you commit to pay a fixed amount per unit of energy produced (or a fixed monthly payment, in the case of a lease). Just like a loan, though, you’re cutting your monthly electricity bill and hanging on to your cash.

Over half of U.S. states permit solar PPAs and leases, so there’s a good chance that zero percent-down solar is an option for your home.

The other big option is to pay cash for a rooftop system. The cost for an average-sized installation usually ranges from $11,000 to $15,000 after solar tax credits. Check also for municipal and/or utility incentives applicable to your home.

If you’re still thinking “all very cool—probably won’t work for my home, though,” then you might have missed our opening sentence: according to Google’s Project Sunroof, four out of five homes in the U.S. are “solar viable” (meaning that there’s enough unshaded area for solar panels). It’s also incredibly easy (and free) to have a solar installer assess your home’s potential.

Solar can now be an affordable investment on almost any budget—even during tough economic times. By powering our homes with the sun, we can untether ourselves from fossil fuels, save money, and take part in the transition to a clean energy future. All in all, it’s getting harder to find a good excuse not to go solar.

Originally published in the 5/27/20 edition of our Flip the Script newsletter