This article was first published in an October 2021 issue of Flip the Script, a weekly newsletter moving you from climate stress to clean energy action. Sign up here to get it in your inbox.

2022 update: According to a recent IMF report, the burning of coal, oil, and gas was subsidized by $5.9 trillion in 2020. This new way of calculating the proper pricing of pollution takes into account the health costs of air pollution and contributions to the impacts of global warming.

—

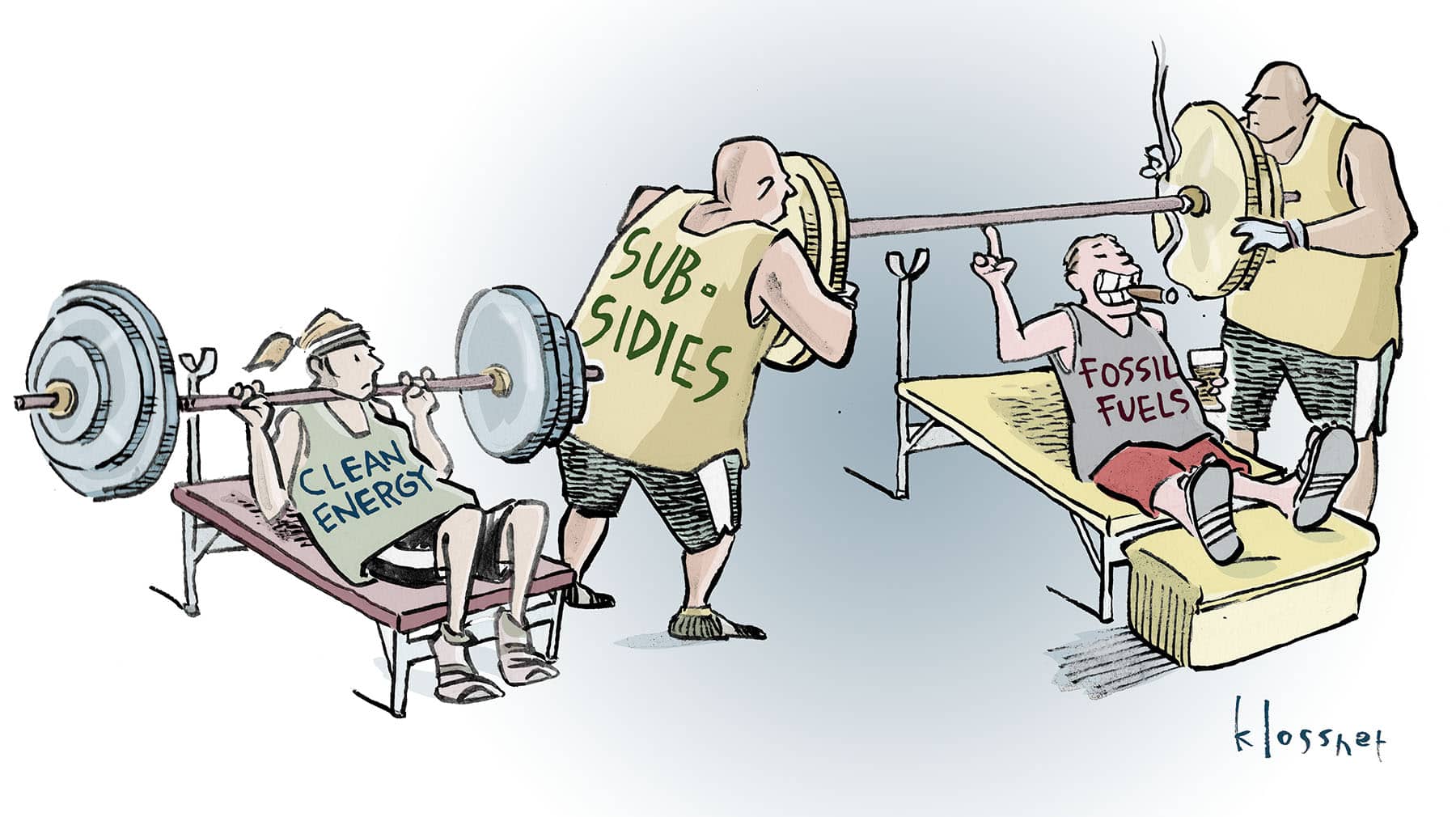

By now, it’s abundantly clear that we need to transition to a clean energy system at “wartime mobilization” speed. By now, it’s abundantly clear that we need to transition to a clean energy future as fast as possible. Continued massive subsidies for fossil fuels is a primary offender for this delay. U.S. taxpayers spend tens of billions of dollars a year subsidizing new fossil fuel exploration, production, and consumption, which directly affects how much oil, gas, and coal gets produced—and how much clean energy doesn’t.

Despite what the coal, oil, and gas industries (and their entourage of politicians) would have us think, most of us would be shocked at how much we prop up fossil fuels versus renewables. The playing field isn’t even close to level. Here’s a breakdown of some numbers of which every American citizen should be aware.

The high price of subsidies

First, let’s consider just the direct subsidies for fossil fuel production—money that flows directly from the government to fossil fuel companies to support activities like exploration, extraction, and development. A conservative estimate from Oil Change International puts the U.S. total at around $20.5 billion annually, including $14.7 billion in federal subsidies and $5.8 billion in state-level incentives. A whopping 80 percent of this goes to oil and gas (with the rest supporting coal), and most of the subsidies are in the form of tax deductions and exemptions and other “obscure tax loopholes and accounting tricks” that result in massive avoided costs for fossil fuel producers.

U.S. taxpayers spend tens of billions of dollars a year subsidizing new fossil fuel exploration, production, and consumption, which directly affects how much oil, natural gas, and coal gets produced—and how much clean energy doesn’t.

By comparison, direct U.S. subsidies to renewables are much smaller, and renewable energy developers aren’t even able to access many of the same breaks that fossil fuel industries do. Moreover, most of the tax breaks that renewables get—like the investment and production tax credits for wind and solar—are only temporary (so far), with expiration dates looming. Looking at the permanent tax expenditures alone, these favor the fossil fuel industry over the renewable energy sector 7 to 1, with permanent tax spending for renewables totaling only around $1.1 billion in 2016.

But this is only a small part of the picture. On top of the direct production subsidies, fossil fuels are bolstered by massive additional supports, including an estimated $14.5 billion in subsidies on the consumption side (payments that help consumers with things like paying for home heating oil), and by around $2.1 billion a year in subsidies paid for overseas fossil fuel projects.

Overshadowing all of these are the indirect or “implicit” subsidies for fossil fuels, which range from the infrastructure spending to maintain the sprawling (and aging) fossil-based energy system, to the diverse impacts that burning fossil fuels has on our health and climate. The International Monetary Fund estimated that the costs to the U.S. government from climate change, local air pollution impacts, and infrastructure damage not captured by energy taxes totaled $686 billion in 2015.

Another massive indirect subsidy to fossil fuels? The estimated $81 billion that the U.S. military spends to protect oil supplies around the globe, including the direct military spending on things like protecting oil shipping routes and maintaining troops near strategic oil-producing locations. This figure doesn’t even include the non-budgeted expenses associated with, for example, the wars in Afghanistan and Iraq and their wider costs in terms of higher oil prices, lost lives, etc., estimated at more than $5 trillion. Altogether, this roughly translates to a subsidy of $100 per ton of carbon dioxide emissions just for protecting U.S. oil interests.

Why it matters

Why do subsidies matter? For one, they directly impact how fossil fuel companies make their decisions moving forward, especially when oil prices are low and the economics might not otherwise work out. A Stockholm Environment Institute analysis from 2017 found that at low oil prices of $50 a barrel, tax preferences and other direct subsidies would enable nearly half of new, non-yet-developed oil fields to be profitable when they otherwise would not be. This could result in increasing U.S. oil production by 17 billion barrels over the next few decades, or the equivalent of 6 billion tons of carbon dioxide. In other words, the link between subsidies, oil production levels, and climate impacts is very real.

Coal, too, likely wouldn’t be a “viable” energy source in the U.S. without the ongoing subsidies (tax breaks) and supportive regulatory policies that prop it up. New coal plants are no longer economical, and the costs of converting old coal plants to “clean coal” are exorbitant (many existing plants are essentially being paid just to stay open to maintain reserve capacity). Even though fossil fuels increasingly can’t compete with many renewable energy sources, their continued subsidization keeps them on life support, adding to the risk of “locking us in” to carbon-intensive energy sources and their associated emissions. Fossil fuel subsidies also take public funds from other uses, such as social spending and (of course) funding for cleaner energy options.

Why do subsidies matter? For one, they directly impact how fossil fuel companies make their decisions moving forward, especially when oil prices are low and the economics might not otherwise work out.

But the writing is on the wall. Even with massive subsidies, the vulnerability of oil, gas, and coal companies is hard to ignore. Financial regulators worry about the investment risks associated with “stranded assets,” or high-carbon assets like coal plants, oil fields, and other fossil fuel infrastructure that will no longer be financially viable in the context of the transition to clean energy. Already, between 2011 and mid-2020, 95 gigawatts of U.S. coal capacity was closed or switched to another fuel, and another 25 gigawatts is slated to shut down by 2025. Fossil fuel subsidies and perverse energy policies are essentially enabling the fossil fuel “fossils” to hang on by the skin of their teeth.

Moving forward, quicker

So what are our options moving forward? An obvious first step would be to remove direct government subsidies (including tax and accounting loopholes), which is easier said than done. The Obama administration identified $8.7 billion a year in federal fossil fuel subsidies to eliminate, but wasn’t able to get the cuts through Congress, while the Trump administration’s “energy dominance” agenda prioritized speeding up oil, gas, and coal production, which impeded progress on clean energy. President-elect Joe Biden has pledged to end fossil fuel subsidies, but this is still politically tricky. Another key proposal is to introduce a price per ton of carbon emitted, which would greatly increase the cost of doing business for fossil fuel companies, helping to better reflect the true cost of these fuels.

Meanwhile, more money needs to be directed toward the clean energy transition, particularly efforts to “electrify everything” (especially transportation) and to transition the power grid to renewables, so that our economies (and lives) are increasingly zero-carbon, not fossil-fueled. This includes upping subsidies for renewables. As the Environmental Defense Fund has noted: “Yes, we need to price carbon, but we also need to subsidize cleaner alternatives—in the true sense of what it means to subsidize: to do so for the benefit of the public.” So let’s get to work and start leveling the playing field.