This article is from the April 14, 2021, issue of Flip the Script, a weekly newsletter moving you from climate stress to clean energy action. Sign up here to get it in your inbox (and share the link with a friend).

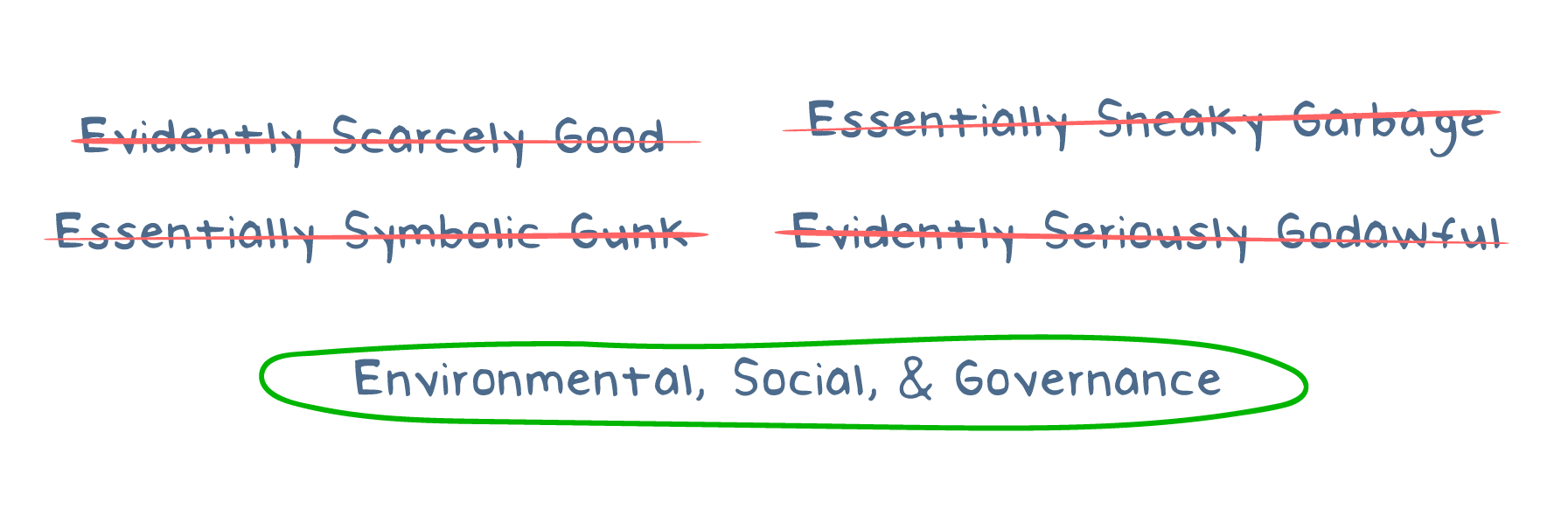

Investors of all stripes are increasingly “investing with their values” by prioritizing portfolios that aim for positive sustainable and societal impact. They’re shifting their assets to so-called ESG (environmental, social, and governance) funds. These are collections of company stocks with certain “do-gooder” criteria, such as clean energy or embracing diversity, equity, and inclusion. By opting for ESG, investors feel like they’re able to advance meaningful change in the business world.

Meanwhile, business leaders and entrepreneurs are jumping on the ESG bandwagon, out of a desire for a more sustainable and socially responsible economic system and/or because they recognize the benefits of riding this growing trend. Globally, investment firms managing some $100 trillion of assets have signed on to the UN’s Principles for Responsible Investment (PRI), and forward-thinking CEOs across the U.S. have joined the Business Roundtable, a coalition of top corporate leaders who aim to reorient capitalism to serve not just shareholders, but also workers and the environment.

ESG funds have come a long way since the 1990s when they first became an option for progressive-minded investors who didn’t feel comfortable with their dollars supporting, say, tobacco or fossil fuel companies. As the number of ESG choices has grown, the associated costs have gone down, and the funds now often outperform their traditional counterparts.

But the big question is, are they actually making a difference? Critics have raised growing concerns about the lack of follow-through on companies’ stated ESG commitments. According to one analysis, investors who signed on to the UN’s investment principles didn’t actually improve the social and environmental performance of their holdings, but instead “use the PRI status to attract capital without making notable changes to ESG.”

So, what can be done to make ESG a more effective and trusted investment tool, and to ensure greater accountability for corporate climate commitments? Here are four key ways:

Better define what qualifies as “ESG”

ESG remains a confusing field, in part because of the lack of uniform definitions and clear metrics. In a recent survey of institutional investors, three-quarters of respondents highlighted a lack of clarity around ESG terminology in their organizations. Without a standard framework for prioritizing among different environmental, social, and governance issues, ESG is a bit of a free-for-all. Managers of several ESG funds have been called out recently for putting “shiny green labels” on what were essentially index funds, heavy in tech stocks and crafted to deliver strong returns over the long term.

In a recent survey of institutional investors, three-quarters of respondents highlighted a lack of clarity around ESG terminology in their organizations.

A big question is, who should really make the cut for inclusion in an ESG fund? Some managers argue that any company that meets certain ESG measures (as defined by the fund) should be allowed entry. The largest U.S. ESG fund, the $25 billion Parnassus Core Equity Fund, concentrates its assets in 40 large cap stocks, relying on metrics such as whether a company has committed to decarbonization. The fund excludes fossil fuel producers and any energy companies that lack a comprehensive carbon-fighting plan. But many of the companies it does include—such as the ag equipment manufacturer Deere & Co., Microsoft, and recently Amazon—have “passed the test” simply because of their ambitious low-carbon commitments on paper, despite these companies’ massive climate footprints.

The catch-all nature of today’s ESG market means that many of the smaller companies that are actually going the extra mile on climate (and that really need the investment boost)—like cutting-edge clean energy start-ups—are being flooded out. Despite its low-carbon intentions, the Parnassus Core Equity Fund has no direct investments in publicly-traded solar companies or other renewable energy producers because, it argues, they aren’t big enough or mature enough to meet its investment criteria.

More transparency = more accountability

A key way to hold companies accountable to their professed ESG principles is to require them to publicly report on their social and environmental impacts, using clear, standardized, and easy-to-understand metrics (on carbon emissions, gender diversity, etc.). That way, investors can know if adding an ESG fund to their portfolio is actually making a difference. With no standardized ESG reporting requirements, it’s a bit like the fox guarding the henhouse, since companies themselves decide what social/environmental data to disclose (if any), which can result in self-serving reporting.

Some argue that the same process that’s currently used in corporate financial reporting (requiring it to be transparent, standard, mandatory, and audited) should also be applied to ESG commitments. Recently, the world’s “Big Four” accounting firms took a step forward by recommending a common set of ESG metrics for companies to add to their existing financial reporting, and, so far, around 61 companies have agreed to use it. But it’s only a voluntary measure. A far bolder step would be for companies to explicitly commit to becoming certified benefit corporations, which requires stating in their charter their aim of balancing profit with a specific public benefit (a key B Corp example is Patagonia).

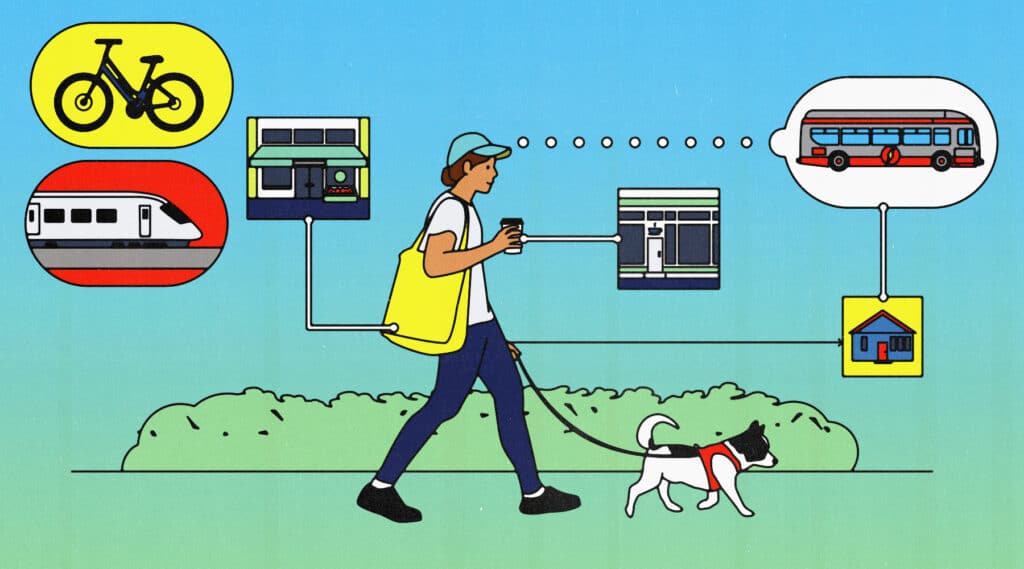

Give climate-friendly funds the priority they deserve

Because climate change has become the defining issue of our era, some analysts argue that’s it’s time to give priority attention to investments that are specifically climate-related. In other words, fund managers should stop lumping in the “environmental” component of the ESG triumvirate with the “social and governance” principles, since they’re a different kind of beast. Climate change in particular deserves its own investment narrative because it has existential impacts and involves a much higher degree of risk than, say, issues like how much a CEO is paid, or the gender mix of a corporate board.

Because climate risk “is impossible to segment across markets and cannot be diversified away,” it has unique implications for how a company’s assets are valued as well as for portfolio diversification, notes Swasti Gupta-Mukherjee, a professor of finance at Loyola University — Chicago. Climate change can impact the physical assets of companies and often results in direct costs, such as damages caused by storms or wildfires. According to Barron’s, as many as 60 percent of companies in the S&P 500 Index hold assets with high exposure to at least one type of physical climate-related risk. This is just one among many reasons to dedicate funds solely to climate-related investments, Gupta-Mukherjee says.

Collectively hold corporations’ feet to the fire

Ultimately, we all have a role to play in making sure companies uphold their ESG commitments—even those of us without large investment portfolios. As consumers, we can make it clear that we expect companies to take a stand on social and environmental issues, as this could make a difference in shifting corporate behavior. As employees, we can also demand more from the companies we work for (whether through protests, walkouts, or just making our values clear). People power can have a significant impact, especially as overall interest in companies’ environmental impacts has grown.

In this context, it would be foolhardy for companies to ignore ESG trends, warn investment managers Michael O’Leary and Warren Valdmanis. They note that as the expectations of company stakeholders have changed, people are “demanding more than hollow marketing and happy talk,” and, as a result, “companies that don’t adapt will find themselves at odds with their customers, employees, investors, and regulators.” Through clearer definitions, more stringent reporting, a dedicated climate focus, and public pressure, ESG investing can become a more effective tool for supporting the kind of sustainable and inclusive future we need.