Tax Credits for Clean Energy at K-12 Schools

The Inflation Reduction Act (IRA) of 2022 enabled the largest investment in U.S. history in fighting climate change and building a domestic clean energy economy – estimated to exceed $370 billion. The landmark commitment include grants, financing, and tax credits that K-12 schools can receive to support new clean energy projects.

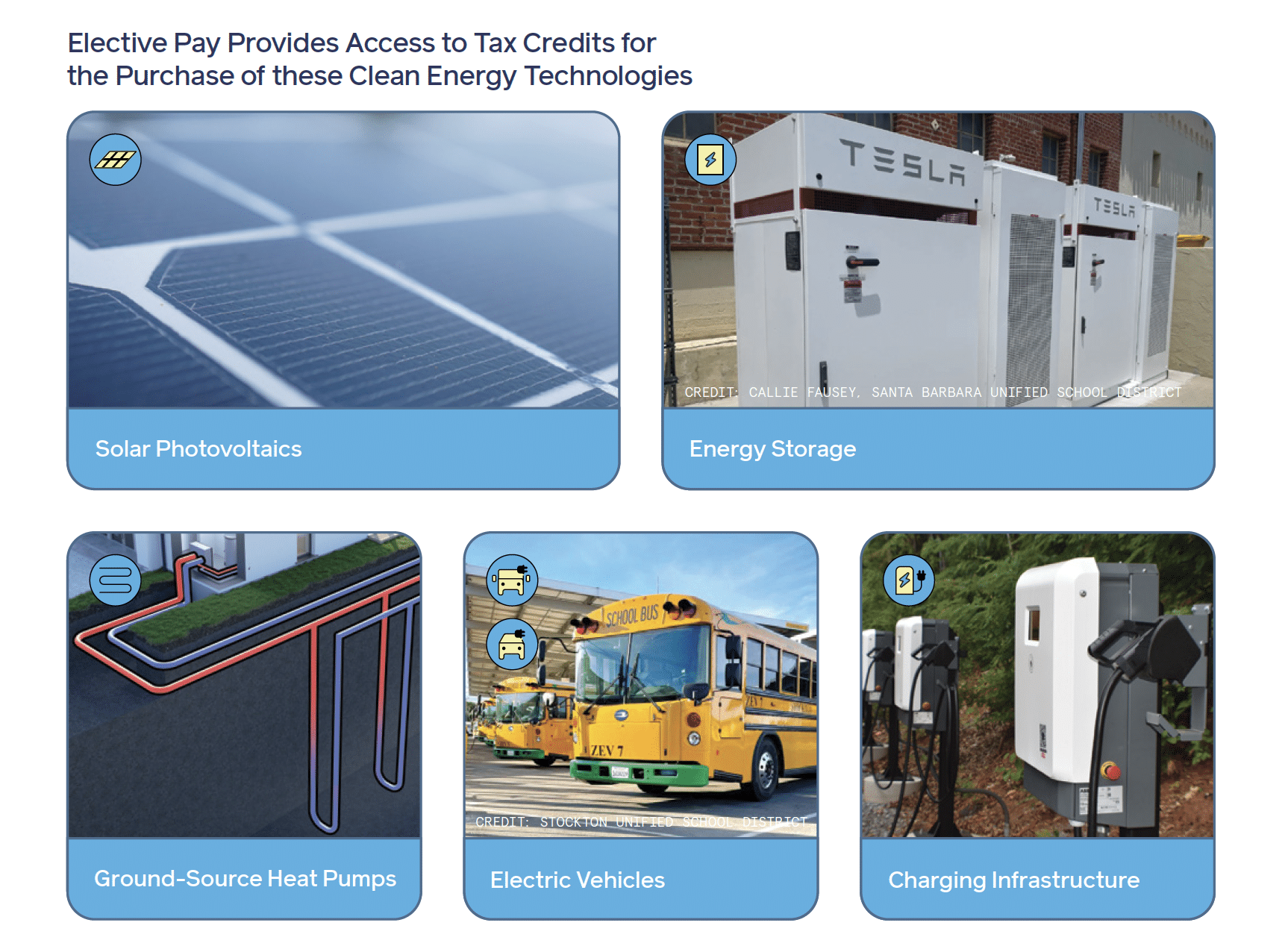

One of the most significant opportunities that the IRA created for K-12 schools and other tax-exempt entities is the ability to receive cash reimbursements for clean energy projects through Elective Pay (also known as Direct Pay).

Use this resource to understand what clean energy technologies are eligible for Elective Pay and the process for receiving a reimbursement.